Your Dream Life Starts Here!

Take Control of Your Money and Create the Life You Deserve!

Saving Myself is your ultimate guide to mastering your money, ditching debt, and designing a future full of choice, freedom, and abundance.

Does this sound familiar?

You’ve worked hard, but you still feel like you’re living paycheque to paycheque, and your dream life feels out of reach.

You know you should be in control of your money, but deep down, you feel overwhelmed, unsure, and stuck in a cycle of earning and spending with nothing to show for it.

You want more—more choices, more freedom, more ease—but right now, you’re just trying to make ends meet.

You’re done with the stress, the guilt, and the fear that comes with not knowing exactly where your money is going or how to make it work for you.

You dream of upgrading your home, taking incredible holidays, or simply feeling financially secure —but right now, you’re just trying to keep up.

You’re tired of promising yourself you’ll get your financial sh*t together—only to fall back into old habits again and again.

If you said yes to any of these, you could be suffering from the Snakes & Ladders Money Trap!

Money can feel like a game of Snakes & Ladders — one step forward, two steps back.

Just when you think you're making progress, life throws an unexpected bill, a financial emergency, or a bad money decision your way— and down the snake you go.

Maybe you’ve tried budgeting before, only to feel like you’re restricting yourself with no real progress.

Maybe you've paid off debt, only to find yourself reaching for the credit card again when things get tight.

Or maybe you’re working hard, earning decent money, but you have no idea where it all goes —leaving you feeling stuck on a never-ending treadmill.

Here’s the truth:

The current financial system wasn’t designed for women.

We weren’t taught how to manage money in a way that works for us.

Instead, we’ve been given one-size-fits-all advice that ignores the way women think, feel, and interact with money.

And that’s why so many of us stay stuck in the Snakes & Ladders Money Trap.

But it doesn’t have to be this way.

The Biggest Money Myths That Keep Women Stuck

If you've ever felt like you're "bad with money" or that you're just not "naturally good" at managing your finances… you’re not alone.

For too long, women have been fed outdated, harmful myths that make financial success seem out of reach:

"Managing money is complicated." – Nope. You don’t need a finance degree, a complicated spreadsheet, or to track every cent to take control of your finances.

"You have to give up everything to get ahead." – Wrong. Wealth isn’t built on deprivation. You don’t have to live on rice and beans or sacrifice the things you love.

"It’s too late for me." – Not true. Whether you’re in your 30s, 40s, 50s or beyond, you can create financial security and start living life on your terms—starting today.

"I should have it all figured out by now." – Guess what? No one taught us this stuff! Most women are learning as they go. The key is to start where you are and take simple, powerful steps forward.

You don’t have to stay stuck in financial stress, uncertainty, or guilt

Your financial future is in your hands. And with the right plan, mindset, and support, you can create a life of abundance, choice, and confidence.

My name is Jo Baker, and Like You...

I knew I was meant for more.

I didn’t want to just "get by" — I wanted choices, freedom, and a life that felt exciting.

💸I was tired of feeling stressed about money.

💸I was sick of wondering if I’d ever feel financially secure.

💸I knew I needed to take control—but I didn’t know where to start.

Then one day, I had a realisation that changed everything:

No one was coming to save me.

If I wanted financial security…

If I wanted a life filled with choices…

If I wanted to feel empowered, confident, and in control…

I had to save myself.

So, sitting on the floor of my bedroom, with nothing but a notepad and pen, I started making a plan.

I got crystal clear on what I wanted.

I mapped out exactly how I’d get there.

And I committed to taking small, doable steps—every single day.

And that plan? It changed my entire life.

And now, I want to help you do the same. Because you have the power to change your financial future—starting today.

Imagine This...

🌟 You wake up feeling secure and stress-free, knowing exactly where your money is going.

🌟 You confidently spend, save, and invest in yourself — without guilt or second-guessing.

🌟 You finally break free from the paycheck-to-paycheck cycle and start building real financial security.

🌟 You stop feeling anxious about unexpected expenses because you have money set aside for life’s surprises.

🌟 You upgrade your home, book that dream holiday, or invest in your future — without worrying if you "can afford it."

🌟 You feel calm, clear, and in control every time you check your bank account.

🌟 You finally have the financial freedom to live life on YOUR terms.

The Good News—you can have all of this

Because I did, and so have many other women I’ve worked with.

I Took Control of My Finances—and Created a System That Works

When I finally decided to take control of my money , I knew I couldn’t just follow traditional finance advice.

The one-size-fits-all budgeting methods?

The strict, joyless spending rules?

The idea that I had to sacrifice everything I loved to get ahead?

🚫 No thanks. That wasn’t going to work for me.

Instead, I created my own approach—one that felt aligned, empowering, and actually doable.

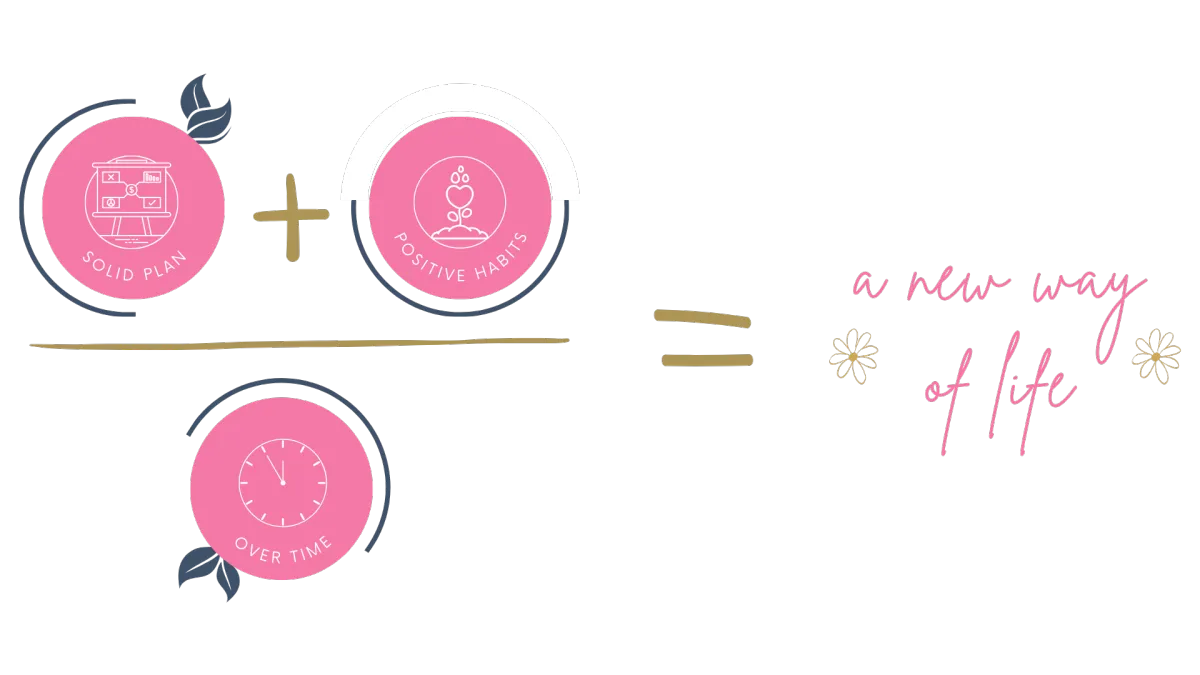

That’s how I developed The Savvy Living Formula — a simple yet powerful method that took me from

financial stress to financial success.

The Savvy Living Formula is simple:

It’s about creating a financial foundation that supports your biggest dreams, deepest desires, and the life you truly want.

✔ A plan that works for YOU —one that helps you get out of debt, grow your savings, and still enjoy life along the way.

✔ Habits that feel natural and effortless —so managing your money becomes second nature.

✔ A long-term approach that makes financial security part of your everyday life—not something you “hope” for someday.

This isn’t about restriction.

This isn’t about following someone else’s rigid rules.

This is about stepping into your power, making confident financial decisions, and creating a life filled with choice and freedom.

And inside Saving Myself, I’m sharing every step with you.

Fast Forward to Now…

I no longer feel stressed or overwhelmed when it comes to money.

❌ I don’t live paycheck to paycheck.

❌ I don’t feel guilty about spending on things that bring me joy.

❌ I don’t panic when I check my bank account.

❌ I don’t feel like financial freedom is just for “other women.”

Instead…

✅ I have a solid plan in place. I know where my money is going, and I’m in full control.

✅ I’ve built powerful money habits that support my goals—without feeling restrictive.

✅ I make financial decisions with confidence —because I trust myself with money.

✅ I have a financial cushion that gives me peace of mind and freedom to say YES to the things I love.

✅ I feel empowered, abundant, and secure.

💡 And the best part? I’m not special.

I didn’t win the lottery. I didn’t inherit money. I didn’t magically “get good” with finances overnight.

I simply followed The Savvy Living Formula—one step at a time.

And now, I want to show you how to do the same.

Saving Myself—Your Step-by-Step Guide to Financial Freedom

I took everything I learned—the exact process that transformed my financial life—and put it into a simple, easy-to-follow guide that any woman can use.

Inside Saving Myself, you’ll find:

📖 A proven roadmap for getting out of the Snakes & Ladders Money Trap and creating lasting financial security.

💡 The Savvy Living Formula—so you can build a solid plan, develop positive habits, and create a new way of life.

💰 Step-by-step strategies to help you get out of debt, grow your savings, and start making confident money moves.

✨ Real-life examples, practical exercises, and empowering insights—so you can take action and see results fast.

This isn’t just another “money book.”

This is a blueprint for financial freedom, designed specifically for women like you.

And the best part? You don’t have to be a financial expert. You don’t have to track every cent. You don’t have to give up everything you love.

💡You just need a plan—and this book gives you one.

Inside Saving Myself, You’ll Discover How To:

💖Escape the Snakes & Ladders Money Trap—so you can stop the cycle of earning, spending, and stressing, and finally move forward with confidence.

🌸 Build a money plan that works for YOU—without giving up the things you love.

💖 Ditch debt without feeling deprived—so you can finally breathe easy.

🌸 Create real financial security—so unexpected expenses don’t send you into panic mode.

💖 Develop powerful money habits—so managing your finances feels effortless and natural.

🌸 Feel in control of your money (and your life!)—so you can make decisions from a place of confidence, not fear.

💖 Upgrade your lifestyle with ease—because financial freedom isn’t just about "getting by"—it’s about living life on YOUR terms.

This book isn’t about restriction or sacrifice—it’s about empowerment, confidence, and creating a life full of choice and freedom.

💕 Ready to Take Control of Your Money and Create the Life You Deserve? 💕

You don’t have to stay stuck in financial stress.

You don’t have to wait for “one day” to start living the life you want.

💡The time is NOW.

💖 Saving Myself gives you the exact steps to build a solid plan, create positive money habits, and finally feel confident with your finances.

✨ And the best part? You can start TODAY.

🌸 Instant access for only $4.95! 🌸

📥 Get the digital copy delivered straight to your inbox—so you can start reading right away!

👇Click the button below and get your copy now! 👇

✨ And the best part? You can start TODAY.

🌸 Instant access for only $4.95! 🌸

📥 Get the digital copy delivered straight to your inbox—so you can start reading right away!

👇Click the button below and get your copy now! 👇

But What If…?

❓“I’m just not good with money.”

💖 No one is born financially savvy! Managing money is a learnable skill—and Saving Myself makes it simple, step-by-step, and completely doable.

❓“I don’t have time to read another book.”

💖 You can read Saving Myself in an afternoon—and start implementing real changes immediately.

No fluff, no overwhelm—just practical steps that work.

❓“I’ve tried budgeting before, and it didn’t work.”

💖 That’s because most budgeting advice is built for someone else’s life—not yours.

The Savvy Living Formula helps you create a money plan that actually fits your lifestyle, your dreams, and what matters most to YOU.

❓“It’s too late for me to turn things around.”

💖 It’s never too late to take control. Whether you’re in your 30s, 40s, 50s or beyond, you have the power to build wealth, create security, and live a life full of choice.

✨ The only way to fail is to do nothing. ✨

🌸 Your dream life is waiting—grab your copy of Saving Myself today! 🌸

👇Click below to get started! 👇

🌸 Here’s What You’ll Learn Inside Saving Myself 🌸

💖 Chapter 1 – Set Up for Success

Lay the foundation for your financial transformation by shifting your mindset and setting powerful goals.

💖 Chapter 2 – Begin Your Business

Think of your finances like a thriving business—because YOU are the CEO of your life.

💖 Chapter 3 – Shift Your Money Story

Rewire the beliefs that have kept you stuck in the Snakes & Ladders Money Trap.

💖 Chapter 4 – Manage Your Mindset

Master the emotional side of money so you can stop feeling guilt, fear, or shame.

💖 Chapter 5 – Nail Your Numbers

Get clear on exactly where your money is going—and take full control of your finances.

💖Chapter 6 – Build Your Budget

Create a financial plan that works for YOU—without restriction or overwhelm.

💖Chapter 7 – Demolish Your Debt

Say goodbye to financial stress with simple, proven strategies to pay off debt faster.

💖Chapter 8 – Nourish Your Nest Egg

Learn how to grow your wealth and create lasting financial security.

💖 Chapter 9 – Hone Your Habits

Turn smart money management into an effortless, daily routine.

💖 Chapter 10 – Take Your Time

Ditch the "get rich quick" mentality and build a sustainable, stress-free financial future.

💖Chapter 11 – Live Your Life

Start enjoying your money, your freedom, and the dream life you’ve built!

💖Chapter 12 – Fashion Your First Aid Kit

Prepare for life’s surprises with a financial safety net that gives you peace of mind.

🌟 Everything you need to create financial freedom is right here. 🌟

🌸 Ready to get started? Grab your copy today! 🌸

👇Click below to buy now! 👇

🌸 Your Financial Freedom Starts Now! 🌸

💖 Imagine a life where money feels easy, empowering, and completely within your control.

💖 Imagine saying YES to the things you love—without stress or second-guessing.

💖 Imagine waking up each day knowing your finances are working for YOU.

✨ This isn’t just a dream—it’s possible, and it starts today. ✨

💡 The only thing standing between you and financial confidence is action.

👉You deserve this.

👉Your future self will thank you.

👉And at just $4.95, there’s no reason to wait.

P.S. Every day you wait is another day stuck in the Snakes & Ladders Money Trap. But today? Today, you can start your journey to financial freedom. Let’s do this together!